The form must be submitted on a yearly basis, or whenever your current personal/financial state of affairs changes significantly. The W-4 form is crucial for businesses with employees because the document assists them in taking the right amount of taxes from their employers’ paycheck. The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxes. Instructions for the Requester of Form W-3 The second page is a straightforward table that needs to be filled out in several easy steps.

W9 form 2021 how to#

The first page contains brief (but very important) instructions on how to complete it, so make sure you read them carefully. Also, do not file this form without the W-2 form. If you have filed the W-2 form online, do not send the W-3 form to the SSA. What You Need the Printable Transmittal Form Forįorm W-3 is a transmittal document that’s used by the employer for the following purposes:Īnd withholding for all the workers in the past year.įorm W-3 must be filed only if a paper copy of the W-2 form is being submitted. While the W-2 form reveals the financial activity of just one employee, the W-3 form focuses on combining the numbers for all your workers in one document. to report their financial activity to the Social Security Administration. Form W-3, also referred to as Transmittal of Wage and Tax Statements, is created for taxpayers in the U.S. If your business has at least one employee, the transmittal W-3 form should also be in your focus zone. You’ve most likely heard of the W-2 form.

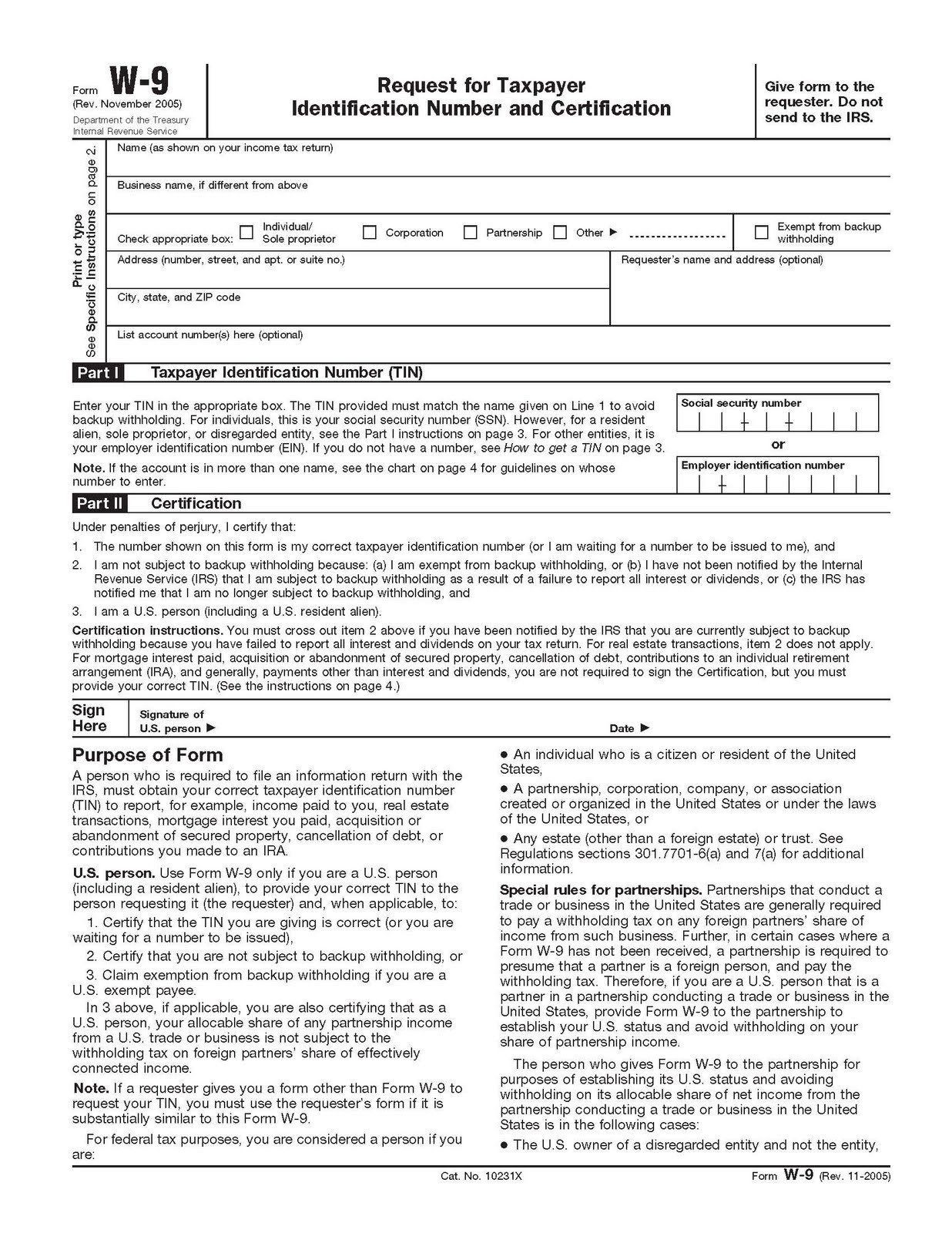

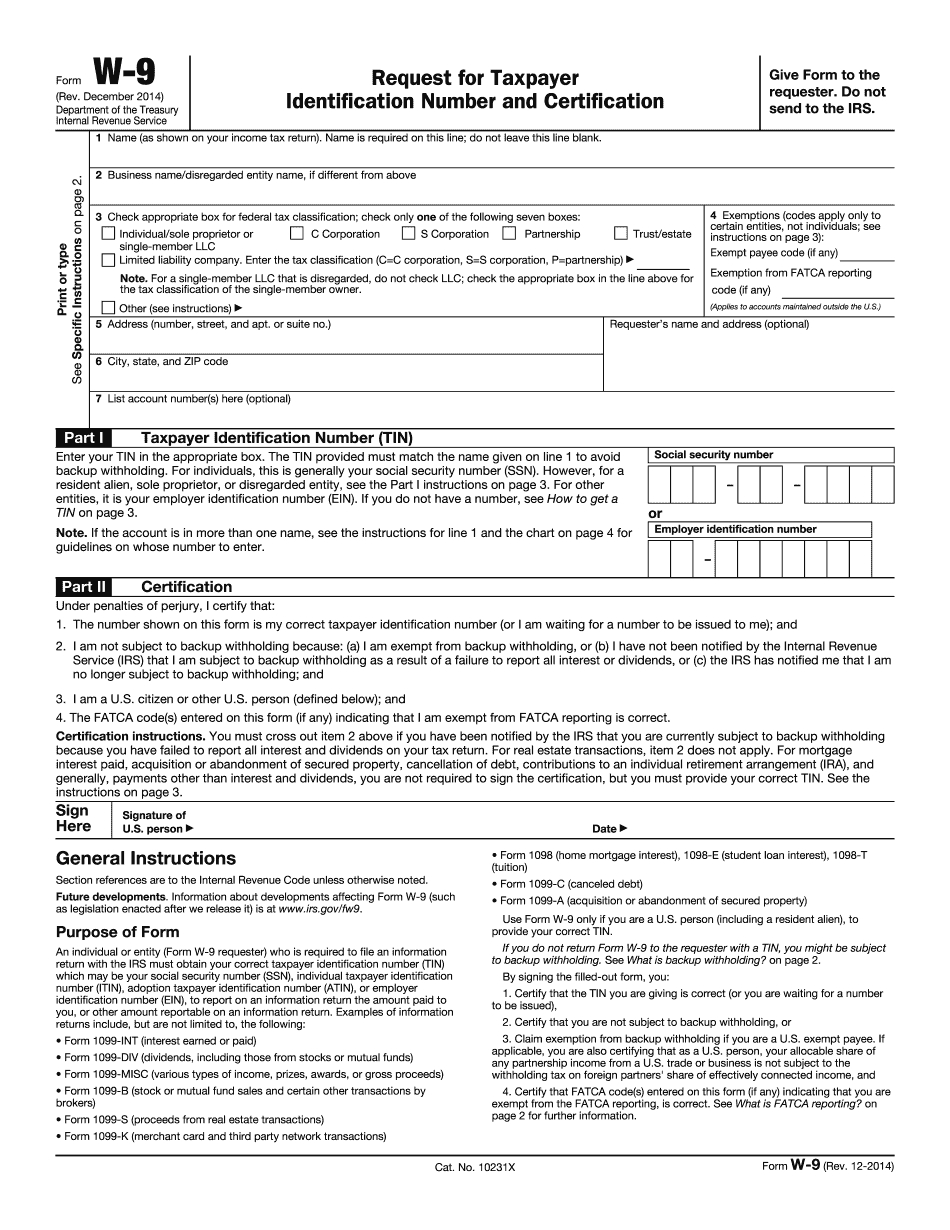

That's where fillable W-9 form comes into play. Filling out W-9 Form in 2022: Covering the BasicsĪll business entities that order your services have to report that income, as well.

0 kommentar(er)

0 kommentar(er)